Over the past 12 months, Nvidia’s top managers have raised more than $1 billion from selling their share packages. At first glance, this fact may raise questions among investors, despite reflecting the standard market mechanisms and the unique dynamics of the chipmaker’s shares.

So far, the market is taking these sales calmly, as evidenced by the absence of a significant correction in Nvidia share price. Despite their size, management’s sales volumes are insignificant compared to the total market turnover of shares and the company’s capitalization of $3.8 trillion.

Moreover, liquidity in ES and Nasdaq futures increased. This may be related to large players hedging and rebalancing positions and due to automated trading, given Nvidia’s record performance and its index weight.

First, the sale of shares by the management of public companies is not a sensation. A significant part of the compensation package of top managers, especially in the technology sector, is traditionally paid in shares. These securities usually have periods of vesting (gradual acquisition of ownership rights). Managers legitimately sell shares to:

- Diversify their portfolio.

- Cover tax obligations.

- Finance personal spendings.

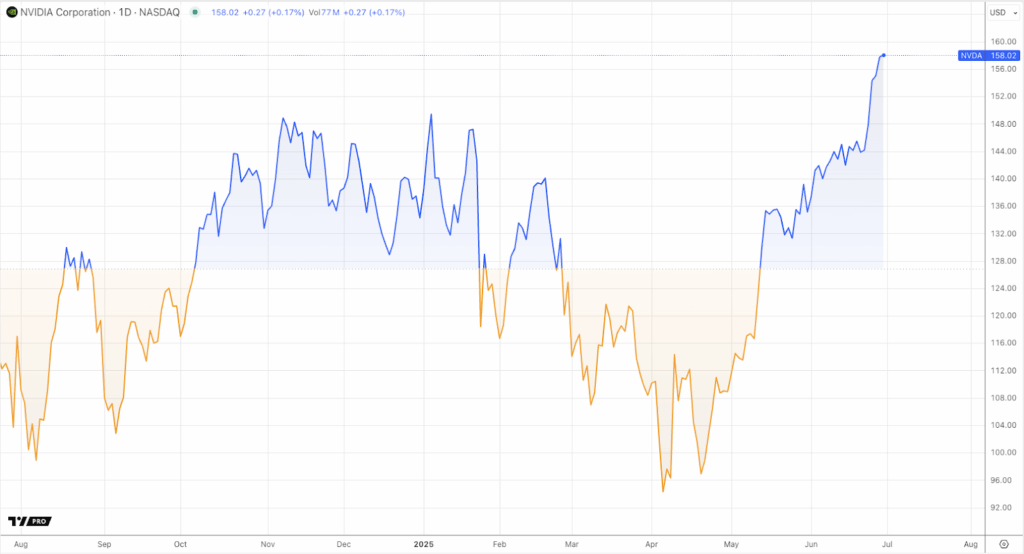

Nvidia’s phenomenon is not due to sales, but to the unprecedented growth in the share value. Due to the dominance of the GPU market for artificial intelligence and exceptionally high demand, NVDA demonstrated phenomenal dynamics. This allowed employees who sold their shares during the year to achieve total proceeds of $1+ billion. The growth was so strong that even regular sales could not exert significant negative pressure on the quotes — demand from institutional and retail investors remained overwhelming.

June is especially significant, accounting for over half of the mentioned billion. This is directly related to the fact that Nvidia shares have not just grown this month but have updated historical highs, allowing the company once again to become the most capitalized public company in the world, surpassing Microsoft and Apple. Last week, its market cap reached a staggering $3.8 trillion.

A landmark event was the return to sales of the founder and permanent CEO, Jensen Huang. After a pause from September 2024, Huang conducted sales last week. This wasn’t a spontaneous decision.

Despite the overall upward trend, the first quarter of 2025 was a period of consolidation and increased volatility for NVDA. The conditions for executing the plan were not optimal. However, the current situation has become as beneficial as possible. The stock exceeding the psychologically important level of $150 was one of the pre-established triggers in Huang’s plan for the resumption of sales.

Jensen Huang may sell up to 6 million Nvidia shares by the end of 2025, bringing him over $900 million at the current share price. It is essential to emphasize that even if Huang decides to sell these shares, he will remain one of the company’s largest shareholders. His total fortune is a whopping $138 billion, which ensures his place among the ten wealthiest people on the planet.

Nvidia’s top managers’ share sales of $1+ billion are a natural result of their compensation policy, multiplied by the extraordinary growth in the company’s value. Jensen Huang’s return to sales is not an alarm signal, but a disciplined execution of a pre-approved plan in favorable market conditions.

The market rightly interprets this not as a lack of confidence in the company’s future, but as a routine financial transaction in the context of record capitalization. The market’s ability to absorb such volumes without disruption only underscores the depth of liquidity and investor confidence in Nvidia’s long-term growth story, fueled by the artificial intelligence revolution.