India’s banking sector has undergone a monumental shift in the past decade, driven largely by the digital revolution. As banks, financial institutions, and fintech players embrace new technologies, the way in which customers access and use banking services is evolving rapidly. With a growing demand for convenience, speed, and personalized services, the digital transformation of Indian banks is no longer optional—it’s essential.

Post Contents

The Rise of Digital Payments and Financial Inclusion

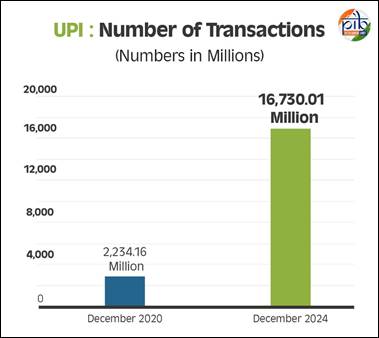

One of the most notable outcomes of digitalisation in the Indian banking industry is the exponential growth in digital payments. From Unified Payments Interface (UPI) to online banking and mobile wallets, customers now enjoy seamless transactions any time, anywhere. UPI transactions alone have surged over the years, becoming a key pillar of India’s payment infrastructure.

Prepaid payment instruments and debit cards have also grown in popularity among users, enabling them to perform transactions with ease across online platforms and physical outlets. This transformation has not only improved access to financial services for the urban population but also expanded financial inclusion across rural India.

Technology as a Game Changer in the Banking Industry

Cloud computing technology and data analytics have become cornerstones of the digital banking ecosystem. Banks now rely heavily on data to improve customer satisfaction, personalize offerings, and predict customer expectations. With advanced analytics, banks can deliver personalized services that cater to the unique needs of the individual customer.

Cloud solutions enable banks to scale up operations efficiently, respond to dynamic customer needs, and reduce operational costs. Furthermore, the use of cloud computing has improved the availability of digital services and enhanced operational efficiency.

Enhanced Security and Regulatory Compliance

As digital payment transactions grow, so does the need for enhanced security and risk management. Indian banks are investing in robust data security infrastructure to protect sensitive customer data and financial information. Regulatory compliance remains a priority, with banks aligning their systems to meet guidelines set by the Reserve Bank of India and other financial regulators.

Enhanced security protocols such as two-factor authentication, biometric verification, and encryption help safeguard digital transactions and maintain trust among customers.

Customer Experience and the Role of Mobile Apps

Digital banking has redefined customer experience in the Indian financial sector. Mobile apps from leading banks such as ICICI Bank, HDFC Bank, and Axis Bank offer streamlined services such as balance checks, fund transfers, bill payments, and loan management. The convenience of mobile banking has revolutionized how customers interact with their bank accounts.

These digital solutions cater to a wide array of customer expectations and have significantly boosted customer engagement. By integrating customer feedback and usage data, banks continue to refine their mobile apps to better serve a tech-savvy user base.

Banking Partners and the Rise of Fintech

Banks are increasingly partnering with fintech firms to accelerate innovation and remain competitive in an increasingly competitive market. These banking partners bring in new technologies, fresh ideas, and the agility required to meet modern-day customer needs.

The collaboration between traditional banks and fintech companies has created a robust ecosystem that fosters innovation in digital banking, lending, insurance, and investments. Financial institutions now offer integrated platforms for online payments, credit access, and wealth management.

Data-Driven Banking: The Power of Analytics

The use of data analytics has revolutionized the banking system. Banks analyze customer data to gain insights into spending habits, creditworthiness, and behavioral patterns. This information allows banks to offer targeted financial services, streamline operations, and predict future market trends.

Analytics also plays a crucial role in risk management by identifying fraudulent activities and ensuring regulatory compliance. The value of data in the digital banking space cannot be overstated—it’s the foundation of modern financial services.

Digital Services for the Digital-First Generation

The digital transformation of Indian banks has resulted in the emergence of digital-only services that cater specifically to the tech-savvy, mobile-first generation. Customers now expect instant account access, real-time notifications, and 24/7 availability of banking services.

Digital banking platforms are continuously evolving to provide better customer experience through intuitive interfaces, AI-driven chatbots, and real-time support. Services such as online shopping, bill payments and investment tracking are now seamlessly integrated into mobile banking apps.

Inclusion of Casino Apps in India’s Digital Growth

Interestingly, the wave of digitization hasn’t just impacted the financial sector. It has influenced lifestyle and entertainment choices as well. Today, users can access a host of apps in the country that <a href=”https://technoxyz.com/how-much-data-does-online-gaming-use/”>offer real-money gaming experiences</a> powered by secure payment options like UPI and net banking.

Among the best online casino apps in India are 10CRIC, PureWin, Parimatch, and Betway. These platforms are known for their user-friendly interfaces, fast withdrawals and tight security protocols.Here is a comprehensive comprehensive casino apps list by SevenJackpots. Much like banking apps, these casino apps prioritise data security and customer satisfaction, emphasizing transparency and regulatory compliance.

The rise of such apps reflects the broader adoption of digital payment methods and how customer engagement is evolving beyond traditional finance.

Future Outlook: What’s Next for Indian Banking?

As banks continue to digitize their operations, the focus will shift to delivering more value to customers while ensuring lower costs and greater efficiency. AI, machine learning, blockchain, and other new technologies will further streamline the banking process, enhance security, and improve decision-making.

Traditional banks must continue to innovate and adapt to stay ahead in an environment marked by rapid technological advancements. By investing in cloud solutions, improving online banking infrastructure, and enhancing customer experience, banks can ensure sustained growth.

The integration of technology into the banking system will also strengthen India’s position in the global financial landscape. As more users embrace digital banking, the demand for accessible, secure, and efficient financial services will only rise.

Conclusion

The digital transformation of Indian banks has ushered in a new era of convenience, speed, and innovation. With advancements in cloud computing, data security, and mobile banking, the banking sector is better equipped to serve the diverse needs of customers across the country.

From digital payments to customer-centric solutions, the future of banking in India is undeniably digital. By embracing technology and focusing on customer engagement, banks can ensure they remain relevant and resilient in a fast-changing world.