In a world where digital innovation and financial strategy intersect, dynamic pricing is a cornerstone for e-commerce success. In the ever-fluid online business landscape, pricing flexibility is not just an option—it’s a necessity. The pandemic dramatically accelerated digital commerce, catapulting sales projections forward by several years. Estimates suggest that the e-commerce sector garnered over $843 billion in revenue in 2021 alone, covering an expansive product spectrum from daily essentials to high-tech gadgets.

Being an online retailer today goes beyond maintaining a 24/7 storefront. It also involves leveraging data analytics and optimizing workflows to adapt to market conditions in real-time. This adaptability extends to international trading, where forex rates add another layer to dynamic pricing strategies. Trusted by giants like Amazon, Airbnb, and Uber, dynamic pricing has already been adopted by one in four e-commerce platforms globally, according to a 2019 survey, with higher implementation rates in subsequent years.

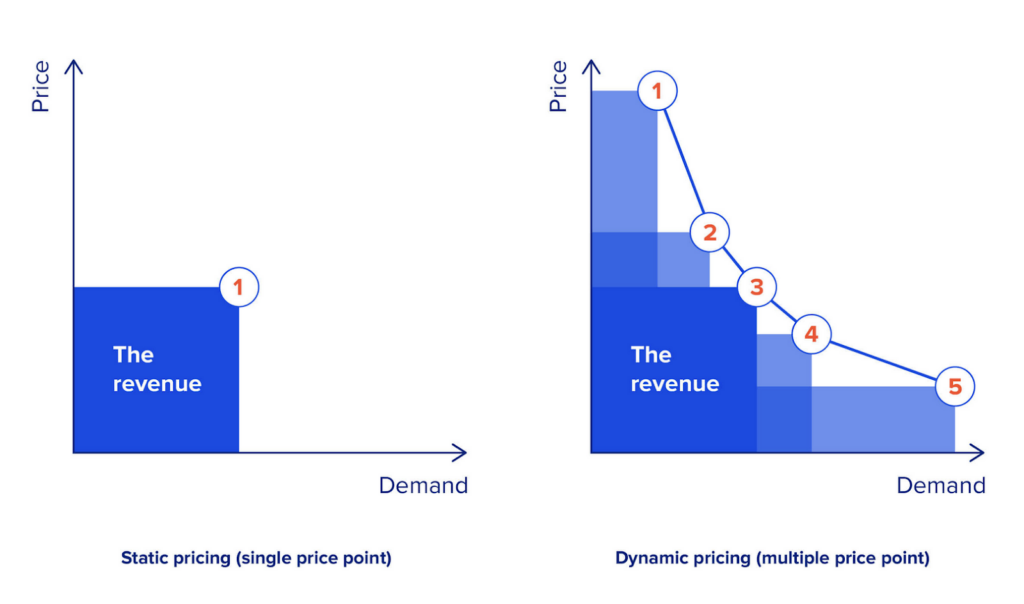

At its core, dynamic pricing adjusts product prices in real-time based on supply and demand. Utilizing continuous market surveillance and consumer behaviour analysis, this agile pricing model accommodates domestic and international market dynamics, including forex rate fluctuations. Early adopters have reported a 10% average increase in profits and up to a 30% uptick in sales, offering a compelling avenue for e-commerce platforms to dynamically adjust pricing to optimize sales and profit.

Post Contents

Dynamic Pricing in Currency Exchange Rates

In the financial world, dynamic pricing isn’t limited to e-commerce; it’s also a critical component of the foreign exchange markets. Currency rates fluctuate due to geopolitical events, economic indicators, and market sentiment.

If you’re an e-commerce retailer venturing into the international market, an introductory course in forex trading can provide valuable insights into the dynamic pricing of currencies. This knowledge enhances your understanding of price volatility for products and the currencies in which they are transacted.

Being an online retailer today means more than operating a 24/7 storefront; it’s about leveraging data analytics, strategically adapting to market conditions, and optimizing workflows in real time. This adaptability also extends to international trading, where fluctuating forex rates come into play as a dynamic pricing component.

Dynamic pricing adjusts product prices based on real-time supply and demand metrics. This approach has yielded significant results, with early adopters reporting an average profit increase of 10% and up to a 30% rise in sales. Even in the foreign exchange markets, understanding dynamic pricing is crucial.

Spreads can widen or narrow based on real-time market conditions, directly affecting traders who must remain agile and adaptable.

Real-life Retail Examples Leveraging Dynamic Pricing

- Walmart: Initially a leader in the loss-leading pricing strategy, Walmart turned to dynamic pricing to compete with Amazon. Post-adoption, its online sales soared by 30%, continuing to grow by 37% in Q1 2019. Latter day figures are shaping up similarly.

- Target: Not just focusing on the U.S., Target employs dynamic pricing algorithms that account for local economic factors in various countries.

- Amazon: Arguably the biggest proponent of dynamic pricing, Amazon changes its prices every 10 minutes on average, contributing to a 25% profit increase.

The Importance of Cross-Currency Rates

Cross-currency rates, or the exchange rates between two currencies where neither is the domestic currency, are particularly significant in international trading. Understanding these rates becomes critical for traders, investors, and even tourists. For example, if you’re UK-based but interested in trading the EUR/JPY pair, you are directly navigating cross-currency rates. These rates also undergo dynamic pricing shifts due to geopolitical events and economic indicators.

Implications for Investors & Traders

Cross-currency rates introduce another layer of complexity for investors diversifying into international assets. Neglecting real-time fluctuations can severely impact the returns on overseas investments. Meanwhile, traders must incorporate risk management strategies to mitigate the losses from sudden price shifts in these currencies.

Whether you’re an e-commerce retailer or a forex trader, dynamic pricing is an all-encompassing strategy, allowing flexibility and adaptability in an ever-changing market landscape. It offers an avenue to maximize profits and optimize sales in various industries, from retail to financial markets.

Strategies for Effective Cross-Currency Dynamic Pricing

- Lock-In Rates Through Forward Contracts: For traders and businesses concerned about future fluctuations, securing rates for a later date provides financial predictability.

- Automated Currency Fluctuation Alerts: Utilizing monitoring systems that offer automated alerts can enhance decision-making capabilities in real time.

- Expert Financial Consultation: Especially beneficial for investors and businesses, consulting financial experts proficient in currency dynamics can offer an invaluable edge.

Ethical Dimensions of Dynamic Pricing

While the financial gains from dynamic pricing are compelling, ethical questions about its fairness persist. Whether it’s varying the cost of a beer in a British pub or setting different rates for international currency transactions, there’s a growing need for regulation and public opinion to influence the practice’s future. This phenomenon is here to stay, so it’s best to understand the market mechanics and implement adoption early on.

The Far-Reaching Impact of Dynamic Pricing

Understanding dynamic pricing in cross-currency transactions is crucial for many individuals, from investors and traders to tourists and global business operations. As this approach continues to be adopted across diverse sectors, its significance in financial performance and ethical ramifications will increasingly come to the forefront.